We’re attending and exhibiting at the BIO International Convention in Boston, the largest conference in biotechnology that brings over 20,000 leaders globally. Read on as Jenny Ro, Director, Biotech, Pharma and Applied Segment Marketing, recaps the key takeaways from each day.

Day 4 was all about some inspiring final sessions!

The global immunology market is projected to nearly double in 10 years and Immunology and Inflammation (I&I) has now emerged as a top investment priority in biopharma, surpassing oncology in growth.

So, I wanted to check out what is cooking in the innovation pipeline for this space and attended:

An Eye on I&I: Innovations Fueling Growth

What are the areas of opportunity?

Judy Chou, CEO of AltruBio said innovation in devices that could provide a more objective readout of a patient’s condition rather than 100% relying on patient reporting is much needed. The example she shared was in inflammatory bowel disease (IBD). Patients have to self-report whether they are seeing any rectal bleeding. It is very common where they reported they don’t experience any rectal bleeding initially but when physicians tell them then they won’t be eligible for a clinical trial, the patients then report out that they had rectal bleeding within the next few days. There are many diseases where having patients self-report is the only outcome measured. This makes it harder to conduct rigorous scientific research.

Daniel Baker, CDO of Cue Biopharma said for small biotech, strategically selecting beachhead indication to develop their clinical program where they could reach the clinical inflection point faster then expanding from there is a good strategy. While doing so, designing your trial and biomarker collection smartly could reveal mechanistic insights of your drug even during a Phase I trial. Such data is valuable in many ways: it informs which indication you could expand to next but also which are most attractive in the eye of a potential big pharma partner.

Judy seconded Daniel with his point and she said limited capital by Biotech shouldn’t limit them from creating a sound strategy and keep raising their value, especially if they use the beachhead strategy that Daniel mentioned.

In I&I space, complex trial design is rather common, yet this could pose challenges down the line where results can be difficult to interpret. What is the panelists’ view on this?

Every panelist said the immune system is complex, so combination therapy or multi-target molecule design is almost a necessity, but this shouldn’t mean you should do it blindly but rather create sound mechanistic rational, so that when the results come back, it would be insightful.

Are we at a point in I&I where we could design a precision medicine like oncology?

Kari Brown, CMO of Revolo Biotherapeutics said, “Not yet!” The immune system is so complex, and multiple pathways could be manifesting into similar symptoms or condition. She used atopic dermatitis as an example.

Daniel Baker noted that, in oncology, precision med is possible because it’s targeting a particular mutation, however, in immunology space the disease arises not due to a mutation but due to a disruption in the whole network. We still lack a comprehensive understanding of the network, so it will be a long way until we could design precision medicine for a group of patients experiencing the same type of network disruption.

Frank Nestle, a Partner on the Deerfield Therapeutics team and the Chief Executive Officer of Deerfield Therapeutic Discovery and Development (3DC), seconded Daniel’s point. For Oncology, molecular characterization of a particular cancer is what made precision medicine possible. For Immunology, they still don’t know exactly what needs to be characterized to be more targeted but drilling down at targeted patient group could provide them with insights in specificity.

Since the dramatic surge in capital flow to the biotech during COVID-19 pandemic and great correction followed, the biotech industry has been struggling with plummeted funding. A cautiously optimistic start of 2025 is still met with continued high interest rate and other macroeconomic conditions where investors are still shying away from this sector.

So, I wanted to get a feel for what the current investors sentiment felt like, and the outlook for future biotech investing by attending:

Strengthening the Future of Biotech Investing

The main takeaway:

All panelists echoed that it’s a tough time right now, but fundamentals of the sector, such as the rising aging population with growing unmet medical needs, is still strong. Ultimately, innovation will always win and market will continue to invest once the uncertainty and high interest rates stabilize a bit. So, all innovators need to just weather this turbulent time with creative ways to stay afloat.

Michael Margolis, Senior Managing Director, Head of Healthcare Investment Banking at Oppenheimer & Co. Inc. shared how he sees at what need to change for better biotech investment climate to return:

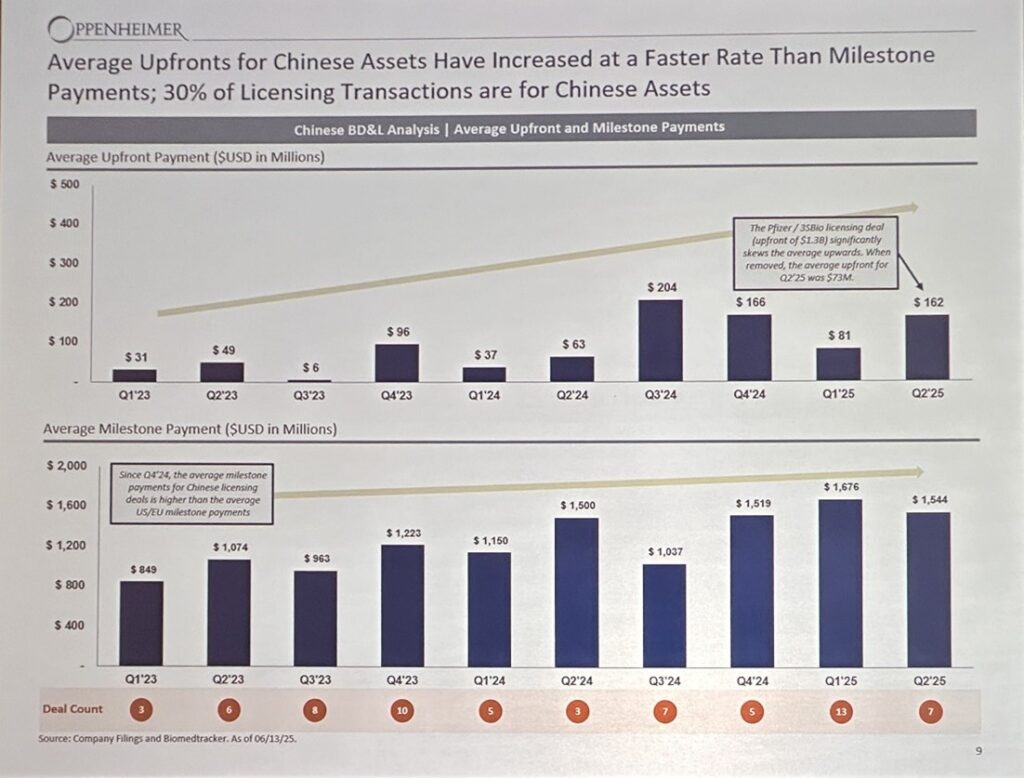

One of the big discussions topics was the biotech market in China and their assets.

More and more pharma companies are licensing or buying out Chinese biotech. What’s shared on public news like above is surely an underestimate because Pharma companies are buying earlier and earlier assets, and not disclosing.

Andrew Lam, Managing Director, Head of Biotech Private Equity at Ally Bridge Group said now people go to China not for lowest price drug asset but because of Chinese biotech’s capabilities. It improved a lot in last 10 years and they have gotten a lot more sophisticated in terms of their pipeline and diversification because they paid attention to what the market wants. Also, it’s so much easier to do business with Chinese biotech than others due to how things are structured in China. He believes this is the beginning of China biotech rather than a short-term hype, so rest of the world needs to get ready.

Rami Rahal, Partner at MPM BioImpact said for all the things Andrew mentioned, MPM has an office in Singapore and consider China as an extension of opportunities. Chinese system allows you to significantly shorten clinical timeline and better patient recruitment at scale and cheaper. So they will be doing more collaboration with China biotech.

Nandita Shangari, Managing Director of RA Capital said clinical trial in China is indeed so fast. They no longer have “me too” drugs and have a lot of good opportunities. So, RA Capital also embraced the doing more things in China as well as giving their portfolio companies exposure to Chinese’s capabilities in clinical space.

Cindy Xiong, Partner at Foresite Capital, born and raised in China, chimed in and said compared with 2015, the tide has turned 180 degree in science and innovation space in China, where they used to mostly in-license drug assets but now everyone is coming to China for out-licensing because their early R&D is so much more efficient and have good innovation. Clinical development and commercialization are still an area where China needs to bridge the gap though.

Michael Margolis agreed that being able to get your drug to clinic is so much faster, but not all drugs can be developed in China because the patient population can be unique or simply not a good fit for your indication, etc. So, it is not a solution for all, but a huge opportunity for many.

Andrew Lam noted that though many early innovations are happening in China, but value capture is still happening on the U.S. side because U.S. pharmas are the one who is buying early-stage Chinese biotech and commercializing those drugs. Medicare projected to run out of money by 2032 will completely change the dynamic of the U.S attractiveness in commercialization though.

In terms of uncovering good Chinese asset, every panelist said you have to put boots on the ground and develop relationship in person rather than reviewing what’s in the data room at the comfort of your own US office. Cindy said Chinese culture is in such way that they really value face-to-face. Echoing this, all panelists said being at the same time-zone and being able to go back and forth quickly or speaking Mandarin are all necessary to build good working relationship with Chinese biotech.

What does everyone think about what’s going on in FDA, has it impacted you personally?

All panelists agreed that there is a lot of noise and uncertainty, but thankfully, the FDA is a little slower than before, but the institution is still functioning on the regulatory side and no real impact has been made to any of their companies.

How can biotech weather the current turbulence in the industry and low funding?

Rami Rahal noted, if you are a small biotech and have a couple promising drugs going through clinic but about to run out of money, think about how you got yourself into that position. It all comes down to inexperience or poor operation. Experienced and sound leadership is largely lacking in small biotech, and this needs to be resolved to give a good drug asset a chance.

Michael Margolis echoed and said investors are being much more prescriptive on what biotech can do with their investment to prevent any potential “waste” by their portfolio companies. He noted, don’t be surprised to see your investor saying, “I’m giving you money to do x and y but not z” or “give me my money back, if you are doing z.”

Walking around the conference today, I could tell it was the last day by looking at everyone’s shoes! Dress shoes and heels came off and most attendees were wearing comfy sneakers.

Great job everyone for working your legs for an intense four days running around Seaport, leaning in, connecting, and exchanging ideas! Life science innovation ecosystem marches on because of all of you. Like what panelists said today, we will weather this together and innovative biotech will come out strong!

Leave a Reply